Conflict minerals

What are „conflict minerals“?

In politically unstable areas, the minerals trade can be used to finance armed groups, fuel forced labour and other human rights abuses, and support corruption and money laundering. These so-called 'conflict minerals' such as tin, tungsten, tantalum and gold, also referred to as 3TG, can be used in everyday products such as mobile phones and cars or in jewellery. It is difficult for consumers to know if a product they have bought is funding violence, human rights abuses or other crimes overseas.

EU importers of tin, tantalum, tungsten and gold for manufacturing consumer goods need to be certified by the EU to ensure that they do not fuel conflicts and human rights abuses in conflict areas. Tin, tantalum, tungsten and gold are used in many consumer products in the EU, in particular by the automotive, electronics, aerospace, packaging, construction, lighting, industrial machinery and tooling industries, as well as in jewellery.

Current Regulations:

- REGULATION (EU) 2017/821 of the European Parliament and of the Council of 17 May 2017 laying down supply chain due diligence obligations for Union importers of tin, tantalum and tungsten, their ores, and gold originating from conflict-affected and high-risk areas

- Commission Recomendation (EU) 2018/1149 of 10 August 2018 on non-binding guidelines for the identification of conflict-affected and high risk areas and other supply chain risks under Regulation (EU) 2017/821 of the European Parliament and of the Council

- Commission Delegated Regulation (EU) 2019/429 of 11 January 2019 supplementing Regulation (EU) 2017/821 of the European Parliament and of the Council as regards the methodology and criteria for the assessment and recognition of supply chain due diligence schemes concerning tin, tantalum, tungsten and gold

What is due diligence?

In simple terms, due diligence is how a business understands, manages and communicates about risk. This includes the risks it generates for others, and the risks it encounters through its strategic and operational decisions and actions.

A technical description of due diligence would be as follows: it is the processes through which enterprises identify, prevent, mitigate and account for how they address their actual and potential adverse impacts (OECD guidelines for multinational enterprises, chapter II – general policies, para. 10). Supply chain due diligence is an ongoing, proactive and reactive process through which companies monitor and administer their purchases and sales with a view to ensuring that they do not contribute to conflict or related adverse impacts.

Due diligence can be included within broader enterprise risk management systems, provided that it goes beyond simply identifying and managing material risks to the enterprise itself, to include the risks of harm related to matters covered by the OECD guidelines (OECD due diligence guidance for responsible business conduct, draft 2.1, p. 8). The OECD easy to use guidance (p. 6) provides a full description of these risks.

The minerals covered by this Regulation come largely from areas where there is a difficult security situation and where armed groups that control mining sites and use the local population, including children, operate to extract raw materials in very difficult conditions, Proceeds from mining flow into the hands of these groups and thus contribute to the outbreak or continuation of violent conflicts. Serious situation in the security and human rights, the international community increasingly concerned, especially within the Organization for Economic Co-operation and Development (OECD), on whose recommendation guidelines are also supported new legislation of the European Union .

What is the scope of my due diligence and what am I expected to do under the OECD guidance?

If you are a downstream company, doing your due diligence means:

You need to identify the smelters and refiners in your supply chain.

Once you have identified the smelters and refiners, check whether the company/ies have successfully passed their audit. Under the EU regulation, the Commission will issue a list of global responsible smelters, taking into account those covered by supply chain due diligence schemes recognised by the Commission.

Source: European Commission

Assess smelters’ and refiners’ due diligence systems against the OECD DDG.

You will need to request information from your suppliers to understand if and how they manage risks. If you are not satisfied with the information provided, you could also request that they provide examples of how they have managed the relevant risks in the past or how they intend to do so going forward.

If you are a small company, you might find it hard to identify smelters and refiners.

In this case, try to cooperate with other companies to identify smelters and refiners in your supply chain. In particular, your suppliers (who in theory should be upstream from you) should be closer to the smelters/refiners in your supply chain, and so may have more information. You can also join industry associations that support their members with their due diligence efforts.

Introduce a supply chain transparency system to map your supply chain.

This will be used to identify smelters and refiners in the supply chain and to identify information about red-flag locations of mineral origin and transit. This information will help you identify countries of origin, transport and transit of metals in the supply chain for each smelter and refiner. The 'due diligence ready!' platform provides a due diligence toolbox which lists information on potential tools that can help you with this.

Keep a record of your due diligence process, communication, decisions made and the reasons for certain decisions being made.

Maintain these records for a minimum of 5 years.

Closely monitor risks when they are identified.

Regularly assess risk – for example annually, depending on the degree of flux in your sourcing practices – to see if anything has changed since your previous risk assessment was carried out.

and recommended questions to guide your risk identification and assessment.

The meaning of the new EU legislation and the impact on Croatian importers

The aim of the new legislation is to limit the possibilities of armed groups to participate in the trade in tin, tantalum, tungsten, their ores and gold. The regulation is intended to ensure the transparency of the supply procedures of Union importers and smelters and refiners who obtain minerals from the areas concerned. The point is not to stop taking raw materials or metals from existing partners, but rather to put pressure on mining sites to bring about the desired changes.

Croatian importers covered by the regulation will now have some due diligence obligations (corporate social responsibility) that will make their supply chain more transparent and controllable.

What are the new responsibilities?

Importers covered by the Regulation will now be required to adapt their internal management structure so that they can obtain and evaluate information relevant to these risks, and to incorporate this "due diligence" approach into their contractual relations with suppliers. Importers will be interested in the origin of the raw materials they purchase and will assess the risk that these raw materials do not come from "irresponsible" sources. Their system will be subject to regular audits by an independent auditor, except when they purchase exclusively from already verified sources. In addition, importers will be required to publish information on their due diligence procedures on an annual basis. They should also pass on relevant due diligence to their customers.

What is the difference between being ‘conflict-free’ and being ‘responsible’?

A company’s aspiration to declare itself ‘conflict-free’ is neither a recommendation of the OECD DDG nor a requirement of the EU regulation.

Doing effective due diligence on your supply chains will help you to source responsibly from conflict-affected and high-risk areas (CAHRAs), not exclude these from your supply chains. This inclusivity of CAHRAs was the original intention of the OECD DDG and the EU regulation.

Regardless of whether you use supply chain due diligence to enable ‘conflict-free’ claims about your business or your products, if you follow the due diligence steps described in the OECD DDG and you manage to demonstrate a significant improvement of your risk management system, then you can claim to be sourcing minerals responsibly.

Learn about the truth behind your smartphone

We all use electronic devices like mobile phones, but where do the materials that make them come from? Tin, tungsten, tantalum and gold are the four most common 'conflict minerals', known collectively as 3TGs. Their mining causes insecurity and human rights abuses in many regions. Armed groups clash over their illegal trade. Fairphone is one manufacturer which takes responsibility to ensure its supply chains extract minerals lawfully.

List of conflict-affected and high-risk areas (CAHRAs)

Under the EU Conflict Mineral Regulation that came into force on 1st January 2021 the definition of CAHRAs is "Areas in a state of armed conflict, fragile post-conflict areas, as well as areas witnessing weak or non-existing governance and security, such as failed states, and widespread and systematic violations of international law, including human rights abuses".

Similarly, the OECD Due Diligence Guidance definition of conflict-affected and high-risk areas is: Conflict-affected and high-risk areas are identified by the presence of armed conflict, widespread violence or other risks of harm to people. Armed conflict may take a variety of forms, such as a conflict of international or non-international character, which may involve two or more states, or may consist of wars of liberation, or insurgencies, civil wars, etc. High-risk areas may include areas of political instability or repression, institutional weakness, insecurity, collapse of civil infrastructure and widespread violence. Such areas are often characterised by widespread human rights abuses and violations of national or international law.

To facilitate compliance with the EU regulation, the Commission prepared non-binding guidelines in the form of a handbook for economic operators, explaining how best to apply the criteria for the identification of CAHRAs, and has called upon external expertise to provide an indicative, non-exhaustive, regularly updated list of such areas. You should use this tool in carrying out due diligence on an existing, a prospective or a new supplier or customer. The above-mentioned CAHRAs list will be updated on a regular basis, as the situation and circumstances in a given geographic area can frequently change and a country or area that is not conflict affected or high risk at the moment might become so later on. Remember that this is an indicative, non-exhaustive list and you should do your own research to further identify all CAHRAs.

If I am sourcing from a CAHRA, will I lose some of my clients?

It is first important to recall that the aim of the OECD DDG is not to prevent sourcing of 3TG from CAHRAs, but rather to ensure that such sourcing does not lead to outcomes such as financing of armed groups, serious economic crimes and human rights abuses. In order to prevent or mitigate an identified risk, companies can either continue to trade and take risk mitigation efforts, suspend trade while pursuing such efforts, or disengage with a supplier after failed attempts at risk mitigation.

If your company discovers that one or more of your suppliers sources minerals from a CAHRA, you should not stop doing business with them as the first response. If you intend to continue to source from the CAHRA, you must make all reasonable efforts to manage risks and provide evidence (e.g. audits, due diligence documents) to your clients that your due diligence (and thus that of your supplier) is reliable and that there are virtually no risks of financing conflicts or violating human rights. Doing so should increase their acceptance of minerals from CAHRAs in their supply chains. If they ask you to stop sourcing from CAHRAs, open a conversation to see how rigid this view is. Changing suppliers or provenances can be challenging and costly, so you have to be sure that it is necessary for their, and your, business.

How long will it take me to implement due diligence and how can I keep costs down?

Performing due diligence will take some time and resources, but the time you will need will depend on your size and position in the supply chain, the complexity and risk profile of your supply chains, your experience in setting up management systems, and your access to fast-track proportionate solutions. In fact, there is a lot of variability in how a company may conduct due diligence and the OECD DDG is designed for this flexibility. As an SME you are likely to have fewer suppliers than larger companies and to have long-lasting business relationships with them. This should enable you to progressively accumulate the kind of information necessary to set up and do adequate due diligence in a reasonable time frame.

If you are a company with many suppliers, consider joining an industry association to combine forces with other companies and leverage greater power. Also consider introducing management systems (potentially including a data management system that assists the collection, aggregation and reporting of due diligence data). You can find a full list of IT solutions in the due diligence toolbox. A data management system could save you time in collecting and aggregating information and you will be able to focus your time on mitigating risks you identify through the system.

Another way to save time and money is to look into integrated software-based data management and compliance solutions. These can help you increase efficiency and thus minimise costs by combining compliance with different laws and supplier outreach. For instance, some IT solutions can help you comply with requirements/guidance on responsible sourcing as well as comply with several regulatory/legislative requirements in a combined and cost-effective fashion.

What is the difference between downstream and upstream companies? Which type am I?

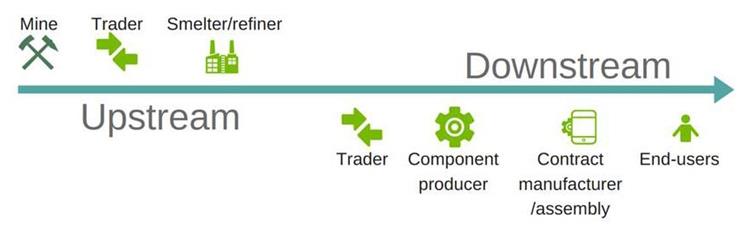

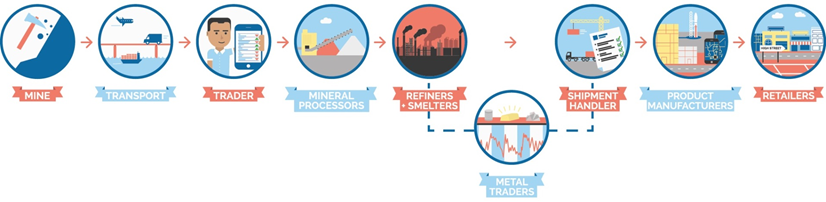

The terms ‘downstream’ and ‘upstream’ are used to indicate different stages of production processes and use in the mineral supply chain and in industry. In simple terms, upstream companies are those active in the stages from extraction up to (and including) smelting and refining. Downstream companies are those that process the output from smelters and refiners into semi-finished products and final products. Look at the supply chain below: all companies to the left of and including the smelters and refiners are companies located upstream, all companies to the right of the smelters and refiners are companies located downstream. The more downstream a company is, the closer it is to the end-users/consumers.

Overview of a mineral supply chain

Source: OECD

Companies downstream of the refiners and smelters include metal traders and exchanges, bullion banks, other entities that do their own gold vaulting, component manufacturers, product manufacturers, original equipment manufacturers, jewellery manufacturers and retailers. It also includes other companies using processed metals in the fabrication of products, such as manufacturers and retailers of electronics equipment and/or medical devices. Companies upstream include those active in extraction (artisanal and small-scale up to large-scale producers), local traders and exporters from the country of mineral origin, international concentrate traders, mineral re-processors, refiners, and smelters.

The role of the Ministry of Foreign and European Affairs

The Ministry of Foreign and European Affairs is the competent authority within the meaning of the Regulation and ensures its uniform and effective implementation.

European Commission website on conflict minerals:

https://ec.europa.eu/trade/policy/in-focus/conflict-minerals-regulation/

Contact:

Ministry of Foreign and European Affairs

Export Control Division

Tel: + 385 1 4598 123

+ 385 1 4598 134

E-mail: kontrola.izvoza@mvep.hr